FC-TRS

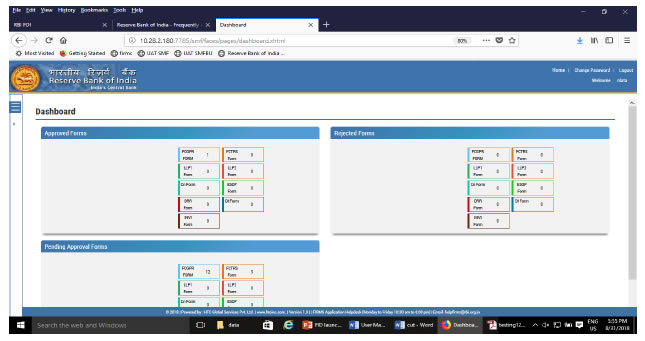

Step 1: Login into SMF and reach your workspace.

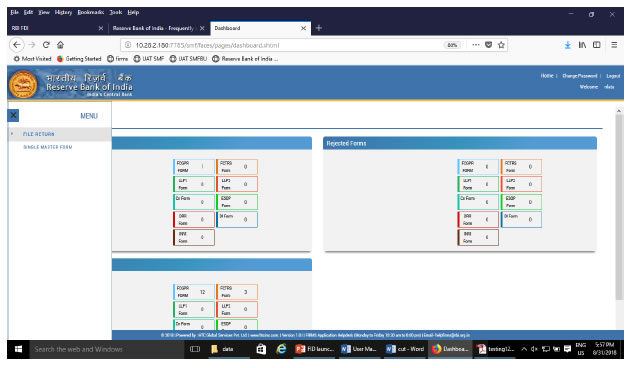

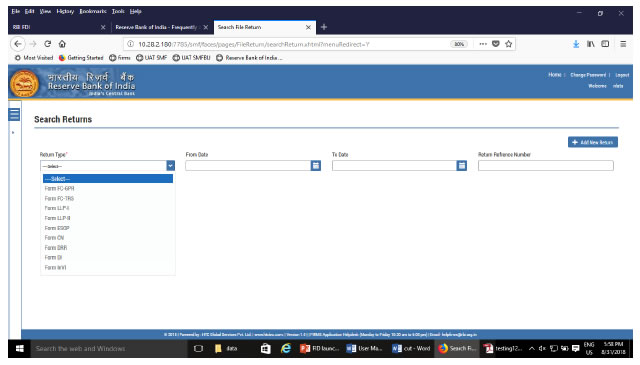

Click on the left navigation button and select Single Master Form.

Step 2 : Click on drop down menu “Return Type”. Select “Form FC-TRS” and click on Add new return. The user will be taken to form FC-TRS.

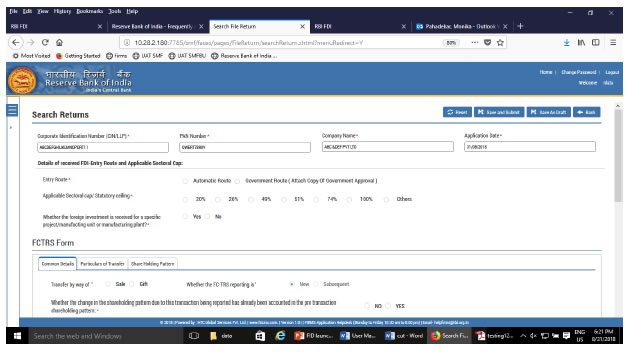

The complete form is arranged into two parts, Common Investment details and “Form FC-TRS” which is further arranged into 3/4 tabs.

(Common Investment details: These details are common to all returns that can be reported in SMF.)

Step 3: Fill up the common investment details as below:

| Field Name | Description | ||||||||

| CIN | Pre-filled, non-editable as per the BU registration details | ||||||||

| Company name | Pre-filled, non-editable as per the BU registration details | ||||||||

| PAN number | Pre-filled, non-editable as per the BU registration details | ||||||||

| Application date | Pre-filled, non-editable, system date | ||||||||

| Entry Route* | Select Automatic or Government as applicable for the investment being reported. In case the Government route is selected attach the requisite Government approvals. Clarification: where the company belongs to a sector with mixed entry routes, for example brownfield pharmaceuticals where up to 74% is under automatic route and beyond up to 100% under Government route. If the investment being reported is under 74%. The entry route selected shall be automatic and in case the investment being reported would result into foreign investment beyond 74%, the entry route selected shall be government with relevant government approvals attached. | ||||||||

| Applicable Sectoral cap/ Statutory ceiling* | Applicable sectoral cap as per FEMA 20(R). Clarification: where the company belongs to a sector with mixed entry routes, for example brownfield pharmaceuticals where up to 74% is under automatic route and beyond up to 100% under Government route, the applicable sectoral cap would be 100%. | ||||||||

| Whether the foreign investment received is for a specific project/ manufacturing unit/ plant? | Select Yes or No as applicable. If yes is selected, fill up the details as below:

|

Step 4 : Fill up the details in form FC-TRS as below :

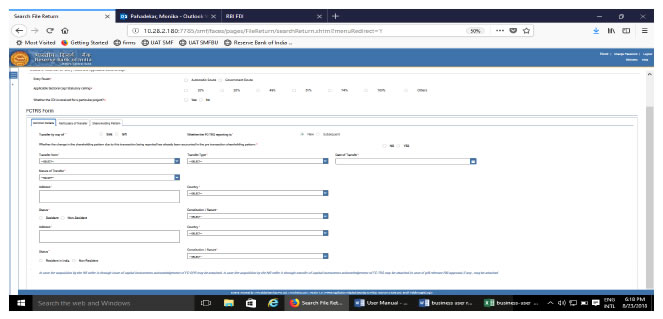

Step 4.1-Tab 1-Common details

| Field name | Description |

| Transfer by way of | Select sale or Gift as the case may be |

| Whether the change in the shareholding pattern due to this transaction being reported has already been accounted in the pre transaction shareholding pattern:* | Select Yes or No In case Yes is selected then there will not be any change in the shareholding pattern for this transaction being reported. In case No is selected changes are reflected in the shareholding pattern for this transaction being reported accordingly. For explanation refer to the chapter under head “Shareholding Pattern” |

| Transfer from | Select from the following options as applicable:

|

| Transfer Type | Select from the following options as applicable:

|

| Date of Transfer | Select the date of transfer from the calendar. (In case the date of transfer is after the date of filing of FC-TRS form i.e future date, select the date as application date and provide the date of transfer as per the Transfer agreement as an attachment under “Other attachments”). |

| Nature of Transfer | Select from the following options as applicable:

|

| Buyer and Seller details for sale or Donee and Donor details for gift | Fill up the buyer and seller details for transfer by sale or Donee and Donor details for Transfer by Gift. |

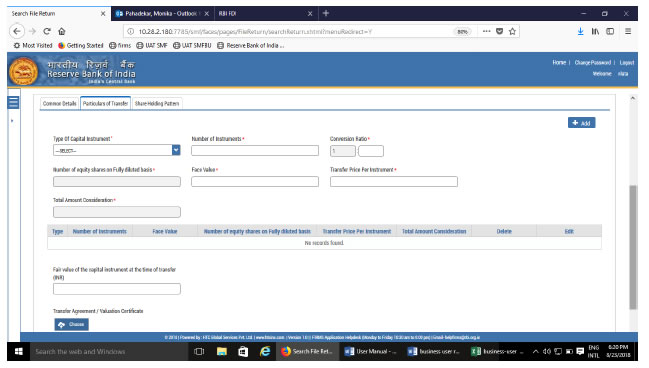

Step 4.2-Tab 2-Particulars of Transfer

| Field Name | Description |

| Type of capital instrument | Select the type of capital instrument as transferred from the drop down menu. In case of gift, if the shares are transferred select as “Shares transferred as Gift”, if not, then the capital instrument as transferred |

| Number of Instruments | Enter the number of instruments as transferred. |

| Conversion ratio | In case of Equity shares, partly paid up shares, shares transferred as Gift, participating interest/rights in oil fields enter as 1:1. For CCDs /CCPs/ share warrants enter the pre-fixed upfront conversion ratio. (In case there is no upfront conversion ratio enter the ratio as per the maximum permissible conversion of CCDs/CCPs/share warrants into equity shares in compliance to the pricing guidelines). |

| Number of equity shares on fully diluted basis | Auto-populated as per the conversion ratio and the number of instruments |

| Face value | Enter the face value of the equivalent equity shares. In case of CCDs/CCPs /share warrants do NOT enter the face value of CCDs/CCPs/share warrants as it will not give the correct shareholding pattern. For participating interest/rights in oil fields enter the value as 0 (zero). |

| Transfer price per instrument | Transfer price. For Gift, enter transfer price as 0 (zero). |

| Total amount consideration | Auto-calculated as Number of instruments multiplied by transfer price per instrument. |

| “ADD” button | Click on the ADD button after entering above details and check that all details are reflected in the adjoining table. In case of multiple instruments being transferred repeat the above process. In case the entered details needs to be modified click on the Edit icon in the table. The details would be re-populated in the fields, modify accordingly and click on Save Button. Check for the details in the adjoining table. In case the details needs to be deleted click on the Delete icon in the table. |

| Fair value of the capital instruments at the time of transfer | Enter the fair value of the capital instrument being transferred and attach the valuation certificate form the authorized person and Transfer agreement (relevant extracts) along with the consent letter of buyer and seller at “Valuation certificate.” In case where multiple instruments are being transferred, enter the fair value of one instrument and attach a clarificatory letter along with the valuation certificates at the attachment “Valuation certificate” In case of Gift, the field may be kept blank. |

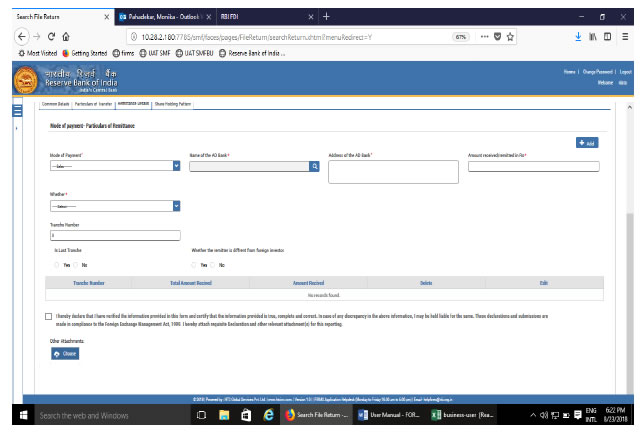

Step 4.3 : Tab 3-Remittance Details – Not applicable for Transfer by Gift

| Field Name | Description | ||||||||||||||||||||||||||||||||||||||||||||||

| Mode of payment | Select from the drop down menu | ||||||||||||||||||||||||||||||||||||||||||||||

| Name of AD bank | Click on the search icon. A pop-up window will open, select the AD bank facilitating the transfer. | ||||||||||||||||||||||||||||||||||||||||||||||

| Address of the AD bank | Address is auto-populated based on bank selection. In case the address is not correct, edit the details accordingly. | ||||||||||||||||||||||||||||||||||||||||||||||

| Amount remitted/received in Rs | Amount in Rs as being received or remitted in this reporting | ||||||||||||||||||||||||||||||||||||||||||||||

| Whether and Tranche number | Select from the drop down menu as below

Payment on deferred basis

In case it is 2,3,4…..etc tranche

Indemnity Arrangement

In case it is first FC-TRS reporting for reporting indemnity payment

| ||||||||||||||||||||||||||||||||||||||||||||||

| Whether the remitter is different from a foreign investor | Please select “NO” if the remitter is same as the foreign investor. In case the two are different (third party payment, if permissible), Please select “YES” enter the details viz., Name of the Remitter, Country of remitter, relationship between Remitter and foreign investor and attach the requisite documents | ||||||||||||||||||||||||||||||||||||||||||||||

| Declaration | Declaration text- I hereby declare that I have verified the information provided in this form and certify that the information provided is true, complete and correct. In case of any discrepancy in the above information, I may be held liable for the same. These declarations and submissions are made in compliance to the Foreign Exchange Management Act, 1999. I hereby attach requisite Declaration and other relevant attachment(s) for this reporting.* Check upon completing all details in the form. |

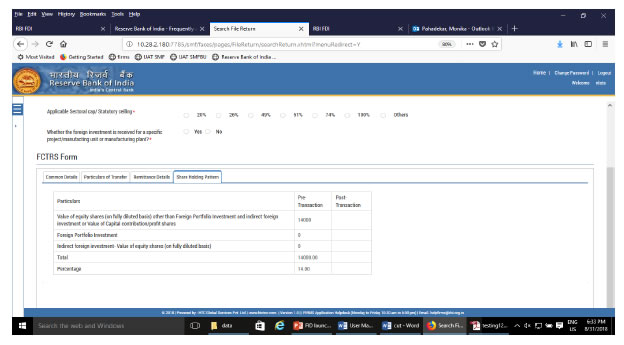

Step 5.5-Tab 5-Shareholding Pattern

| Field name | Description | ||||||||||||||||||

| Shareholding pattern |

Pre transaction values are auto-populated from the Entity Master (tab 3) |

Step 5.6: After filling in all details, click on Save and Submit for submitting the form.

“Save as draft” feature: The Business User can also save the draft and submit later, by filling in all mandatory details in the “Common details” page.